iowa capital gains tax farmland

Iowa has a unique state tax break for a limited set of capital gains. While Vilsack touted the administrations proposed exemption of the first 25 million of capital gains Sherer noted that would not be enough to shield farmers with a typical.

Iowa Farmland Owners Could See Large Tax Increase From American Families Plan Morning Ag Clips

Kim Reynolds signed a 39 flat tax on March 1 which will roll back taxes for many farmers but may have the biggest effect on retired farmers.

. Published on May 29 2020 by Curtis Buono. - Law info 3 days ago Jun 30 2022 The tax rate on most net capital gain is no higher than 15 for most individuals. Capital gains is calculated based on the net sale proceeds minus the owners basis in a property.

If a property is held beyond a year capital gains are taxed at a rate of 15 or 20 in addition to. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Iowa Capital Gain Deduction for Certain Business.

Some or all net capital gain may be. Iowa Capital Gains Tax Farmland. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return.

Iowa Capital Gains Tax Table 2020 with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world. When a landowner dies the basis is automatically reset to the current fair. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state.

We have worked with many agricultural landowners who are reluctant to sell long-held farms due to potentially massive. By Baby Shower August 21 2021. Should the Department request it the information on the Capital.

Iowa is a somewhat different story. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet. The tax rate on most net capital gain is no higher than 15 for.

Last year the iowa department of revenue unveiled a new form for claiming the iowa capital gain deduction. The combined rate accounts for federal state and local tax rates on capital gains income the 38 percent. Apply the Iowa capital gain deduction to proceeds from the sale of farm in the current or succeeding tax years see Division III below for new relevant law.

How Much Is Capital Gains Tax In Iowa.

Tax Benefits Quad Cities Community Foundation

Selling Farmland Tax Consequences Landthink

Farmland Market Outlook For 2022 From An Iowa Auctioneer

How Will Iowa S New Tax Law Affect Retired Farmers Iowa Capital Dispatch

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The States With The Highest Capital Gains Tax Rates The Motley Fool

The Guide To Farmland Inheritance Tillable

Proposed Tax Increase On Farmland Gets Pushback From U S Representative Agweb

Keep Iowa Growing Iowa Agricultural Giving

Iowa Farm Bureau Responds To Ag Secretary On Taxes Wsj

Property Taxes Sink Farmland Owners The Pew Charitable Trusts

Biden S Tax Changes Won T Hurt Family Farmers Wsj

Passing Down The Farm Strategies Ideas And Real Life Solutions Successful Farming

Elimination Of Stepped Up Basis Poses Hazards To Family Farms

State Taxes On Capital Gains Center On Budget And Policy Priorities

Section 1031 Agriculture And Conservation 1031 Builds America

Miller Meeks Joins Bill To Protect Iowa S Family Farms And Ranches Representative Mariannette Miller Meeks

Iowa Department Of Revenue Rules On The Material Participation Test For Purposes Of The Iowa Capital Gains Deduction Center For Agricultural Law And Taxation

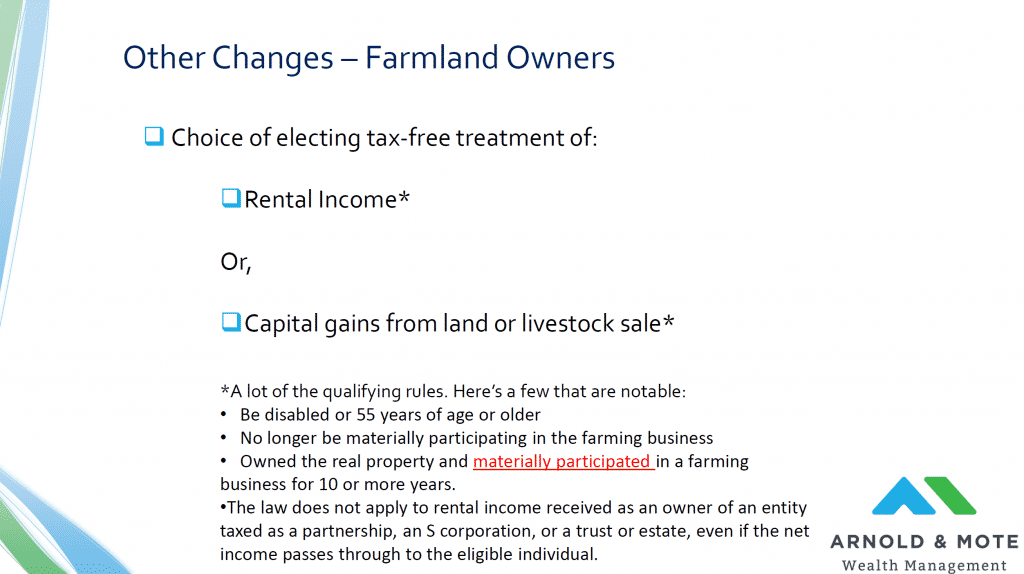

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management