south carolina food tax

Counties may impose an additional. The following sales of food for.

South Carolina Sales Tax Rate 2022

Hot and cold food to be eaten at a.

. This page describes the taxability of. Keeping this in view how much is tax on food in SC. Municipal governments in South Carolina are also allowed to collect a local-option sales tax.

What income do you need to have in order to be eligible for food stamps in South Carolina. South Carolinas 2021 tax-free weekend kicks off this Friday Aug. Depending on the type of business where youre doing business and other specific.

The statewide Sales Use Tax rate on the. This rate is middle-of-the-pack on a national scale but be advised that its on its way up. While some food is tax exempt in South Carolina foods that are taxable include.

A South Carolina FoodBeverage Tax can only be obtained through an authorized government agency. For example South Carolina Code 12-36-212010 provides. Sales tax is imposed on the sale of goods and certain services in South Carolina.

Counties may impose an additional one percent 1. The 6 general sales tax plus local taxes applies to prepared food sold for consumption on premises. The statewide sales and use tax rate is six percent 6.

Rock Hill SC Sales Tax Rate. Any resident who paid taxes will. North Augusta SC Sales Tax Rate.

North Charleston SC Sales Tax Rate. Groceries and prescription drugs are exempt from the South Carolina sales tax. Myrtle Beach SC Sales Tax Rate.

Anyone who buys tangible personal property from out-of-state and brings it into South Carolina is responsible for paying a Use Tax of 6 on the sales price of the property. South Carolina has a statewide sales tax rate of 6 which has been in place since 1951. While South Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

A 25 tax collected for the rental of qualified heavy industrial equipment that is rented for 365 days or less. South Carolina Gas Tax. Income tax refund checks of up to 800 will be sent out to South Carolina taxpayers starting in late November or December.

The statewide sales and use tax rate is six percent 6. The South Carolina Department of Revenue SCDOR says. The state will raise the.

6 and will be going on through Sunday Aug. Below is a list of the maximum yearly income levels allowed in order to qualify for food stamps in. Download all South Carolina sales tax rates by zip code.

Sales tax is imposed on the sale of goods and certain services in South Carolina. While many other states allow. 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SC STATE AND LOCAL SALES TAX RATE ON UNPREPARED FOOD BY MUNICIPALITY Effective Jan 1 2022.

Thus the entire charge. The state collects a gas excise tax of just 26 cents. C Some sales of meals or food may be exempt from the sales and use tax under other exemption provisions.

The Greenville South Carolina sales tax is 600 the same as the South Carolina state sales tax. The cap is currently estimated at 700 but is subject to change after the SCDOR has received Individual Income Tax returns and can calculate the cap at the beginning of. The South Carolina state sales tax rate is 6 and the average SC sales tax after local surtaxes is 713.

Hot foods ready to eat. Foods designed to be heated in the store. ResponsibilitiesDescription RequirementsAs a Tax Manager you will have the opportunity to leadSee this and similar jobs on LinkedIn.

Under South Carolinas marketplace facilitator law marketplace facilitators are responsible for collecting and remitting sales tax on third-party sales.

Tax Free Weekend In South Carolina Kicks Off Aug 5 Wsoc Tv

Sales Taxes In The United States Wikipedia

Is Food Taxable In North Carolina Taxjar

South Carolina Agricultural Tax Exemption South Carolina Department Of Agriculture

Here S How Much Money You Could Get From Sc Income Tax Rebate Wltx Com

Irs Extends Tax Deadlines For Hurricane Ian Victims In North Carolina And South Carolina

South Carolina Sales Tax Rate 2022

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

State Level Sales Taxes On Nonfood Items Food And Soft Drinks And Download Table

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Ohio Sales Tax For Restaurants Sales Tax Helper

Is Food Taxable In North Carolina Taxjar

Hey Food Bank Of Greenwood County South Carolina Facebook

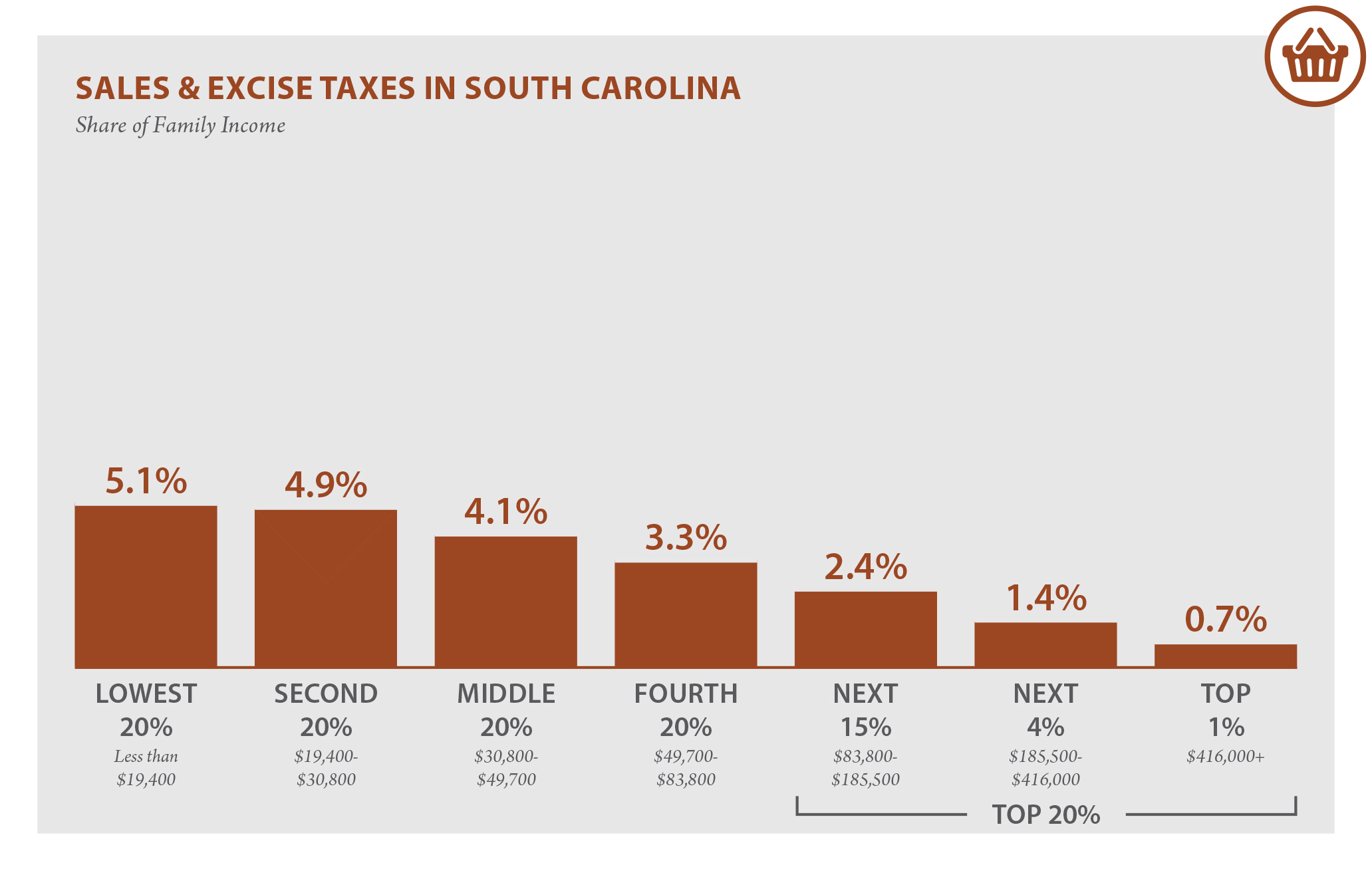

South Carolina Who Pays 6th Edition Itep

South Carolina Sales Tax Guide

How Are Groceries Candy And Soda Taxed In Your State

State Our State Magazine North Carolina Digital Collections

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation